RPA Implementation Boosted Operational Efficiency of International Retail Company

Overview

A challenge occurred when the manual cash transaction processing system of an International Retail and Manufacturing Company’s sub-brand was becoming time-consuming and error-prone. This process involved downloading transaction data, creating spreadsheets, reconciling variances, and applying cash in SAP. The goal was to automate this process to eliminate backlog, reduce errors, and alleviate employee fatigue by using RPA Implementation.

Challenges

- Repetitive manual process: The existing process required three hours of work each day and could lead to further delays while dealing with transactions from non-major credit card issuers.

- Error-Rate: Manual data entry and increased error risk affect financial accuracy and business operations.

- Backlog in Payment Processing: Delays caused by the manual process could create a backlog in payment processing for other vendors, impacting relationships and financial stability.

Solutions

- Automated Data Retrieval: RPA implementation leads the bot log into the virtual machine, where it downloads transaction files and bill summaries and collects data from SAP and the retailer’s local database.

- Spreadsheet Creation and Data Organization: To test the data, the bot creates a spreadsheet and organizes test data for analysis; this is a major step in overcoming the RPA challenge.

- Variance Checking: The bot checks discrepancies between SAP billing and actual billing, and the SMEs are notified of any variance, proving RPA implementation is the right choice.

- Transaction Activity and Cash App Updates: The bot updates the monthly transaction activity table and the cash app spreadsheets to reflect the current data.

- Verification and Email Communication: The bot sends spreadsheets for verification, and upon SME confirmation, it applies to cash in SAP. It also updates the CashApp spreadsheet accordingly.

- Iterative Process: The bot repeats the steps for every transaction until the ‘Not Assigned’ value reaches 0.0, indicating all cash transactions are applied.

Results

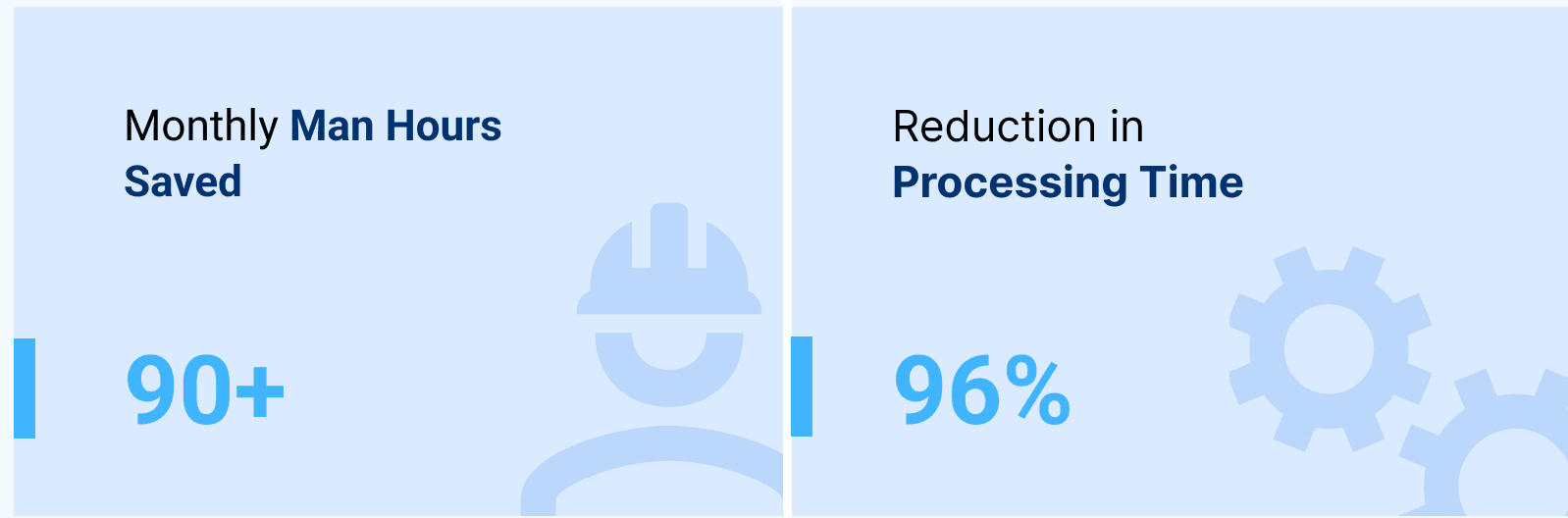

The industrial process automation led to several benefits:

- Efficiency: The process that once took three hours per day now only requires 30 minutes to process an entire month of transaction data.

- Error Reduction: RPA implementation eliminated the risk of human error, ensuring accuracy in financial transactions.

- Backlog Elimination: The automation helped eliminate backlogs in payment processing, improving vendor relationships and financial stability.

- Reduced Employee Fatigue: Employees were no longer burdened by manual, time-consuming tasks, reducing fatigue and improved job satisfaction.

Overall, the automated solution streamlined cash transaction processing, enhancing efficiency and accuracy while minimizing business risk.